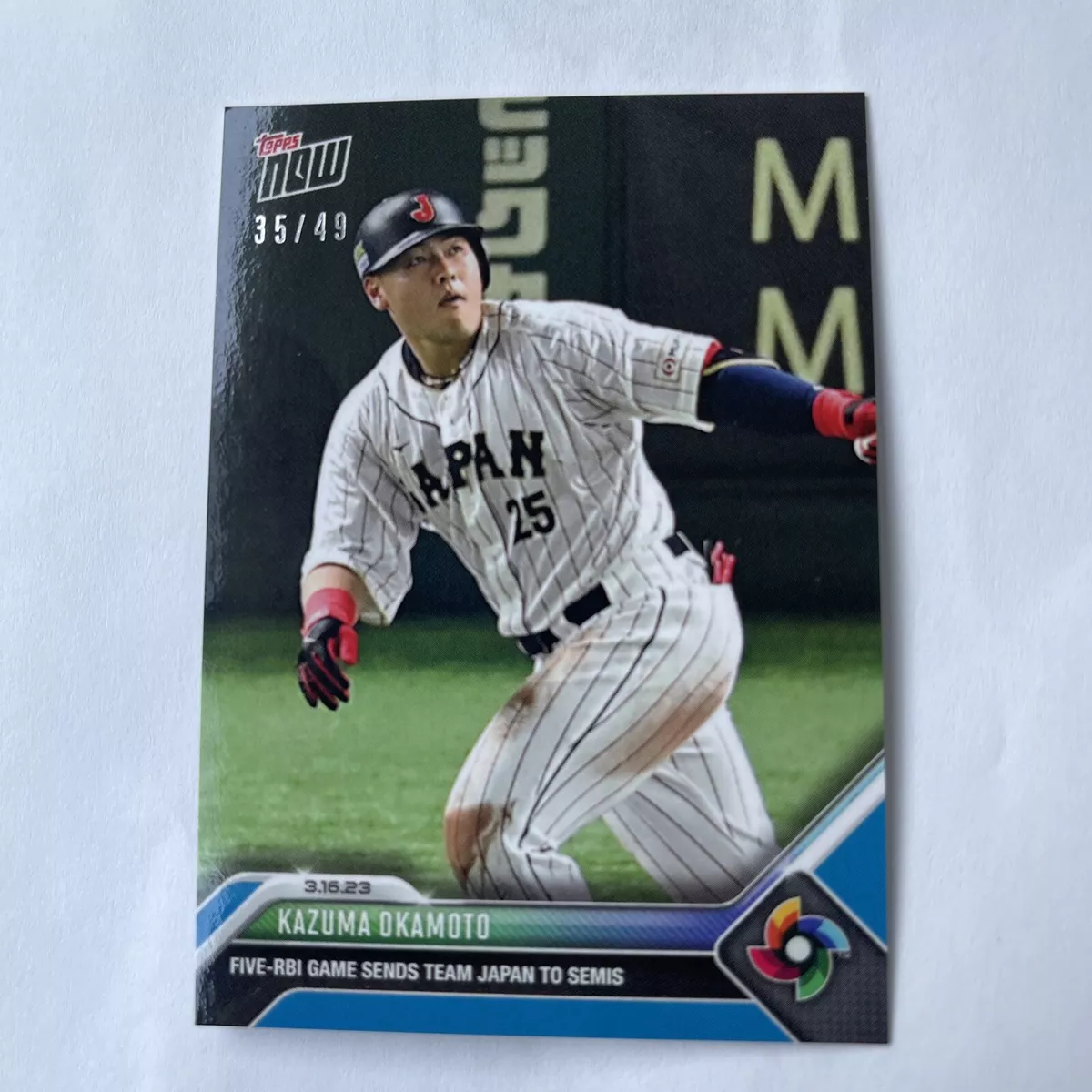

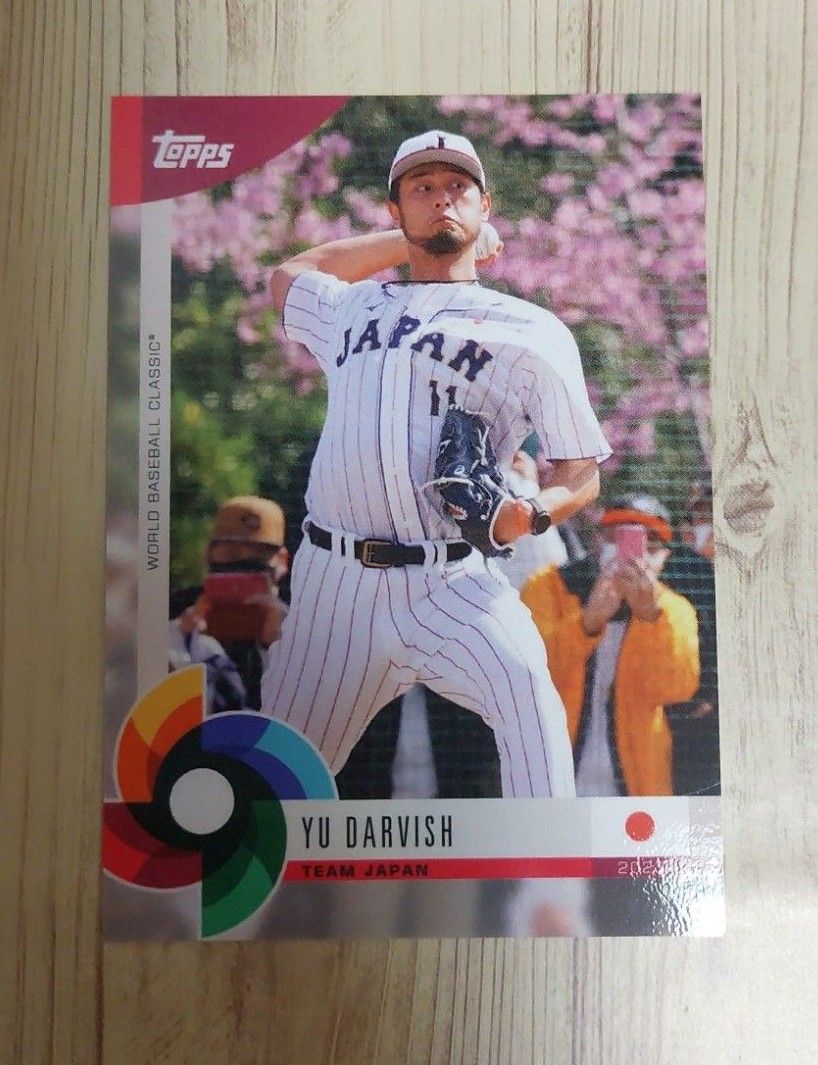

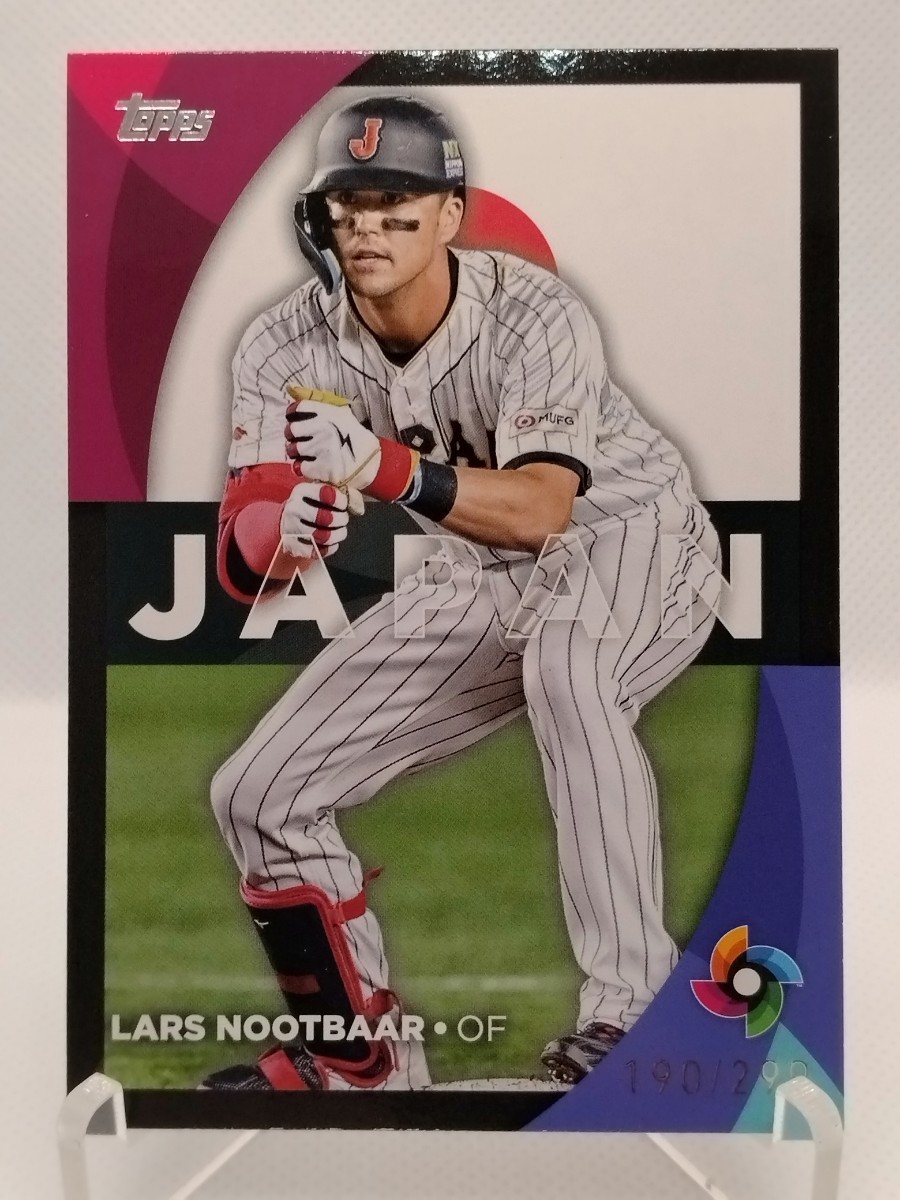

topps WBC カード 35枚 チームジャパン

(税込) 送料込み

商品の説明

カードが35枚入っているみたいです。

初めて購入したのですが、金欠の為出品します。

開けてもいない新品です。

土日、盆休みは出荷できない可能性があります。商品の情報

| カテゴリー | スポーツ・レジャー > 野球 > 応援グッズ |

|---|---|

| 商品の状態 | 新品、未使用 |

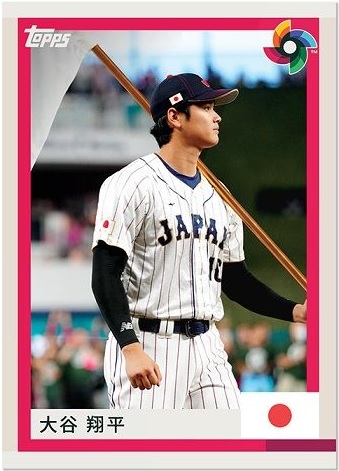

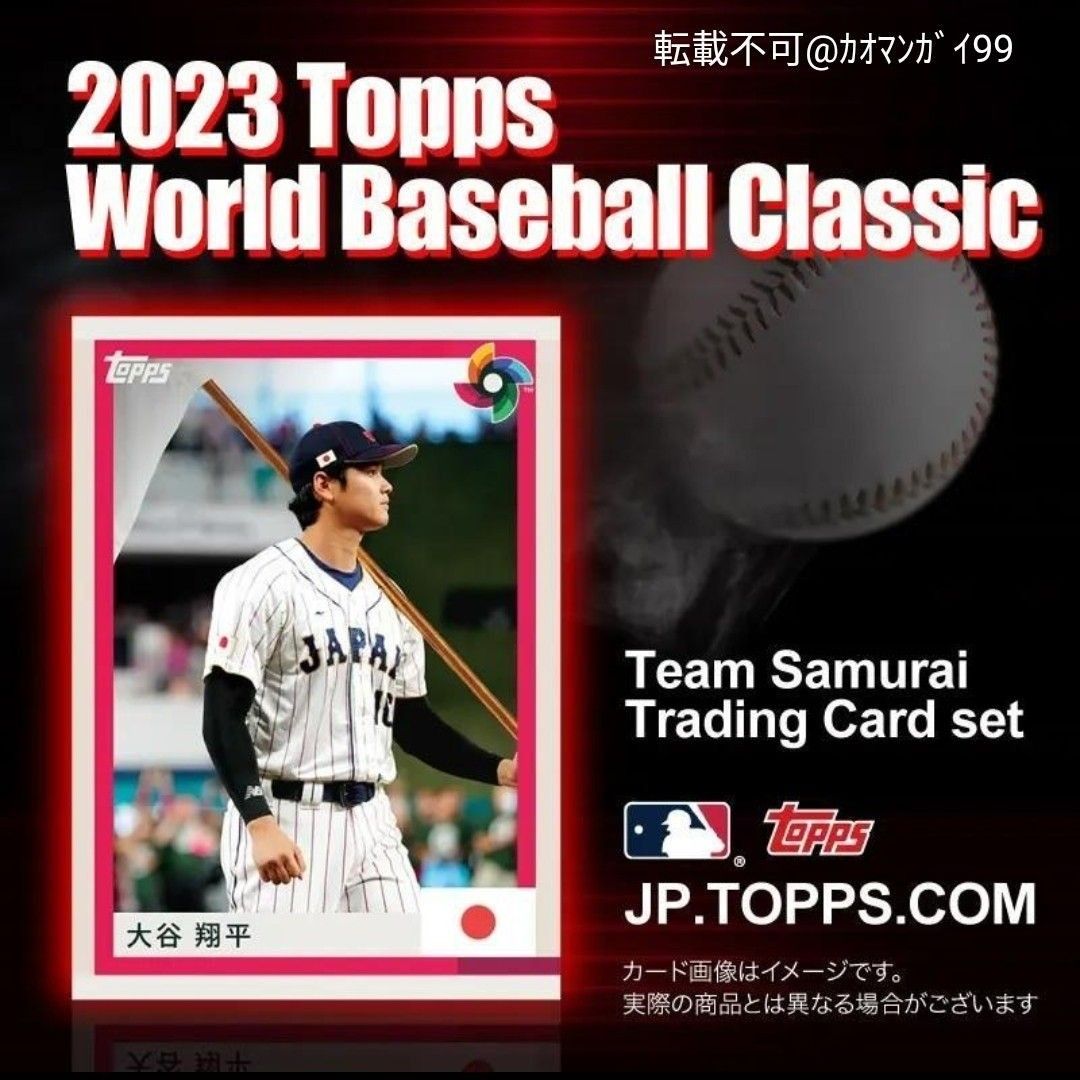

2023 Topps World Baseball Classic - Team Samurai Trading Card Set

佐々木朗希のWBC準決勝ボールカードが当たるかも! TOPPS JAPANが日本

![Amazon.co.jp: Topps Now [WBC記念カード] 日本代表優勝 侍ジャパン](https://m.media-amazon.com/images/I/51W Vg7yqGL.jpg)

Amazon.co.jp: Topps Now [WBC記念カード] 日本代表優勝 侍ジャパン

未開封】2023 Topps WBC侍ジャパンカードセット限定受注生産BOX-

【新品未開封/限定】TOPPS WBC 侍ジャパン カード 完全受注 BOX

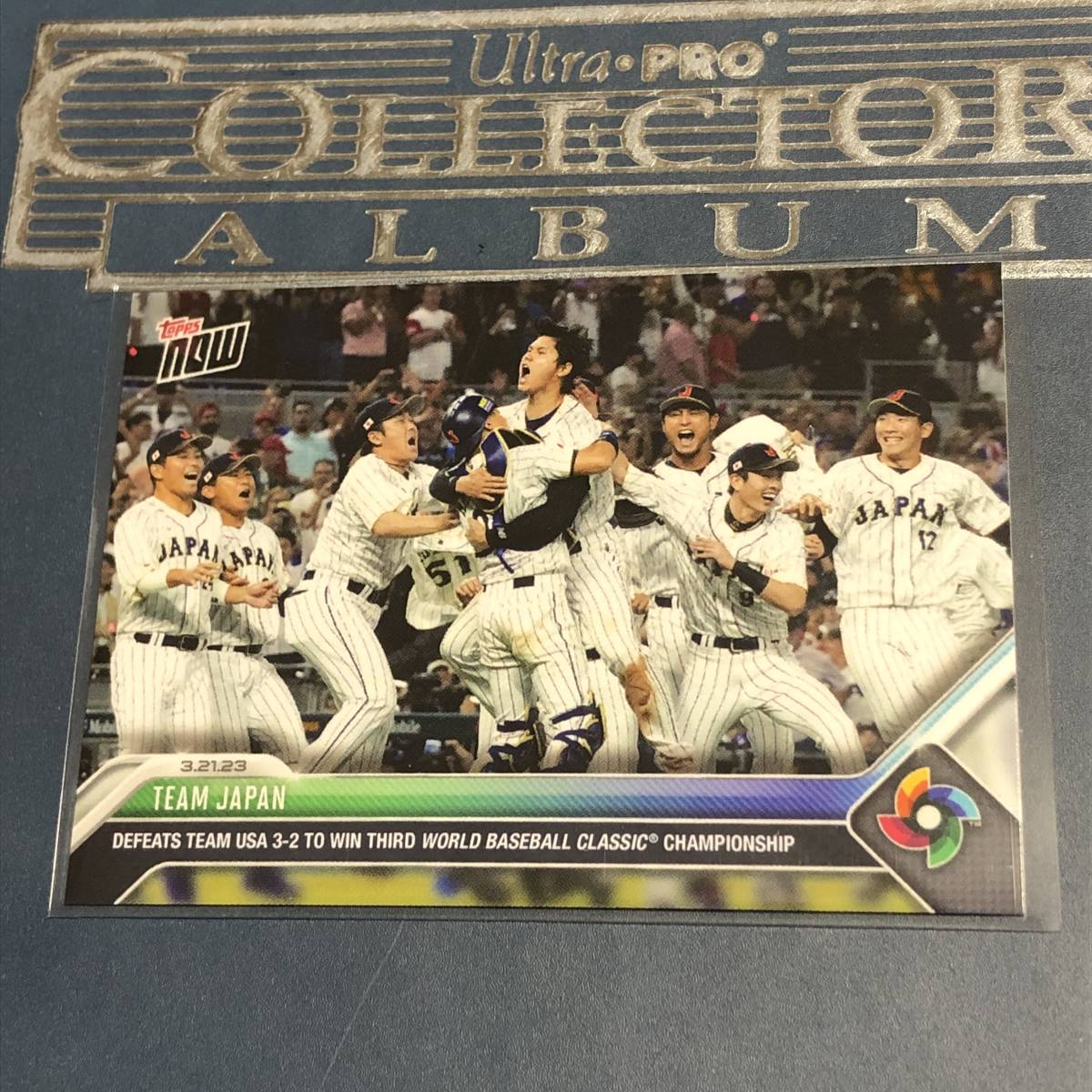

最大93%オフ! 大谷翔平 #WBC-72 アメリカに3-2で勝ち 3回目のWBCの

topps 2023 wbc 侍ジャパン カードセット 未開封品 【正規品直輸入

![Amazon | [WBC記念カード] 準決勝逆転サヨナラ勝ち 侍ジャパン Team](https://m.media-amazon.com/images/I/61oyhsv19 L.jpg)

Amazon | [WBC記念カード] 準決勝逆転サヨナラ勝ち 侍ジャパン Team

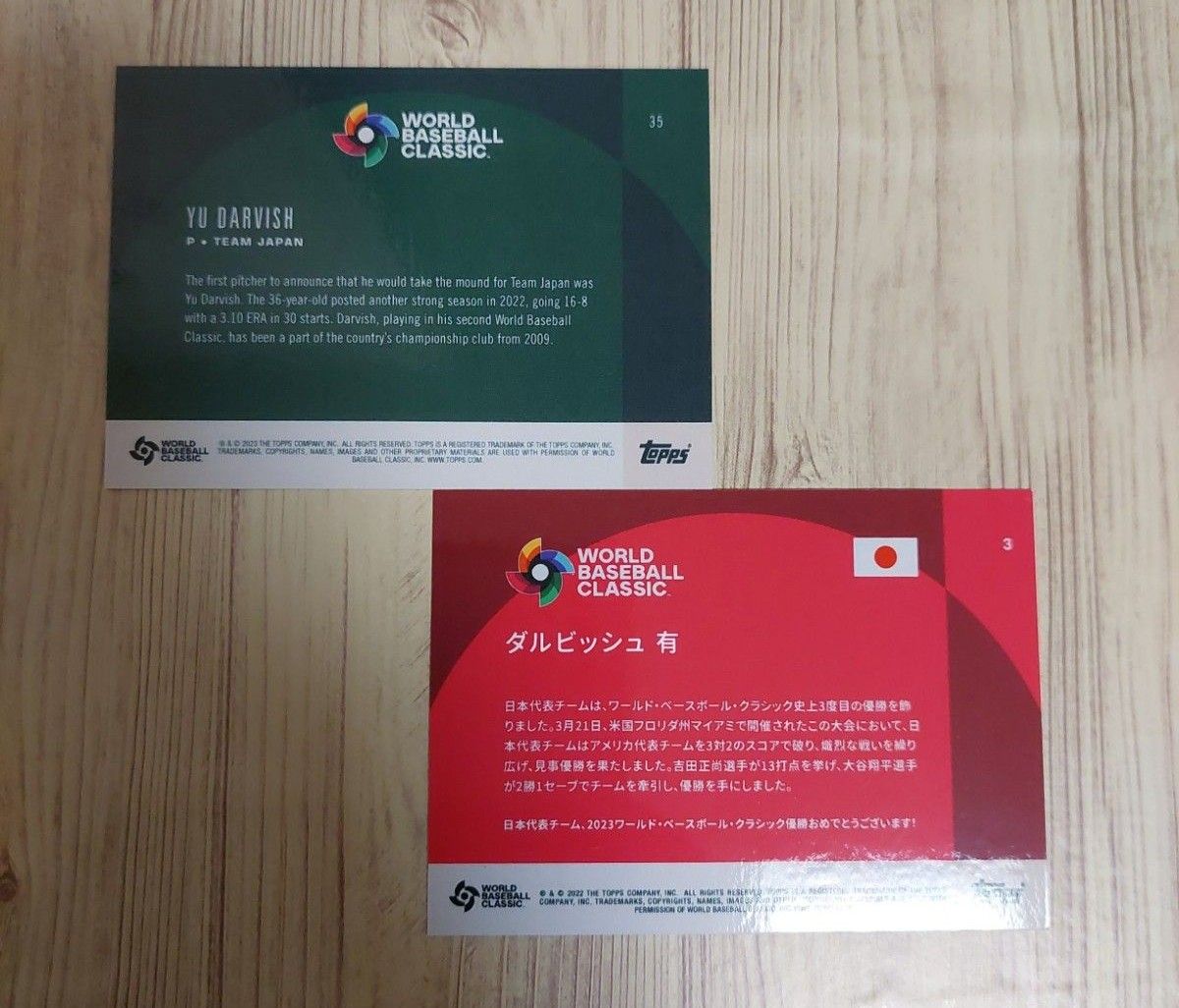

topps 2023 WBC CARD WORLD BASEBALL CLASSIC 99枚限定 ダルビッシュ有

2023 WBC 侍ジャパン トレカセット TOPPS 大谷翔平 正規 48.0%割引 www

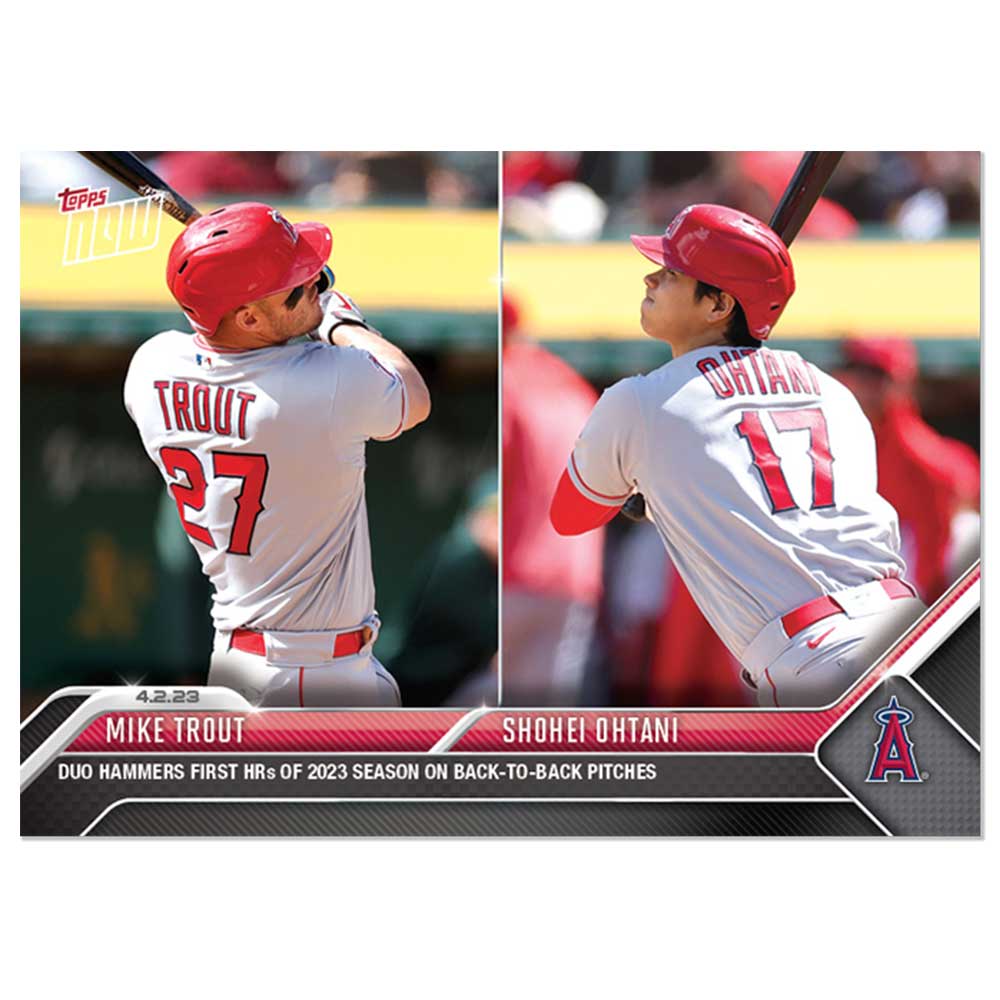

大谷翔平 topps now WBC 大谷翔平-

最大93%オフ! 大谷翔平 #WBC-72 アメリカに3-2で勝ち 3回目のWBCの

新品未開封】topps2023 WBC チーム侍ジャパンカードセット 【お

安価 topps now 大谷翔平 吉田正尚 10枚限定 レッドパラレル wbc

![Amazon.co.jp: Topps Now [WBC記念カード] 日本代表優勝 侍ジャパン](https://m.media-amazon.com/images/I/51W Vg7yqGL._SR600,315_PIWhiteStrip,BottomLeft,0,35_SCLZZZZZZZ_FMpng_BG255,255,255.jpg)

Amazon.co.jp: Topps Now [WBC記念カード] 日本代表優勝 侍ジャパン

2023 Topps World Baseball Classic - Team Samurai WBC 侍ジャパン

卸し売り購入 2023 Topps World Baseball Classic WBCクラシック

PSA10】 2023 Topps Now 優勝 侍ジャパン オススメ-

2023 TOPPS NOW World Baseball Classic WBC 侍ジャパン 優勝シーン

Amazon.co.jp: 2023 TOPPS NOW WBC 侍ジャパン 優勝記念 12枚セット

売り出し純正 2023 Topps WBC侍ジャパンカードセット限定生産BOX

2023 Topps WBC 侍ジャパンカードセット 限定受注生産BOX 未開封

PSA10】 2023 Topps Now Team Japan Blue-

新品】toops 2023 WBC 侍ジャパン トレーディング カード BOX 特選

WBC Topps カード ダルビッシュ有 選手 2枚セット|PayPayフリマ

WBC 侍ジャパン カードセット開封! 2023 Topps World Baseball

Topps Now 2023 World Baseball Classic Champions 12枚セット WBC 侍

Amazon | 在庫少 WBC決勝戦 Topps Now 大谷翔平 カード 侍ジャパン3枚

2023 All-World Baseball Classic Team - MLB TOPPS NOW - 12-Card Set

大谷翔平 topps now WBC 大谷翔平-

ヤクルト 村上宗隆 カード topps NPB 2023 1of1 PSA シリ - スポーツ選手

2023 Topps WBC- Team Samurai 未開封 好評 51.0%OFF www.coopetarrazu.com

Amazon.co.jp: topps now card 近藤健介 侍ジャパン カード WBC 014

最大93%オフ! 大谷翔平 #WBC-72 アメリカに3-2で勝ち 3回目のWBCの

ラーズ・ヌートバー 299枚限定 黒パラレル 【2023 TOPPS | JChere

Amazon.co.jp: 150枚限定 topps WBC 2023 本代表 高橋宏斗選手

ダルビッシュ有 【2023 TOPPS WORLD BASEBALL CLASSIC GLOBAL STARS 35

Amazon.co.jp: topps now card team JAPAN WBC-20 WBC 2023 カード

WBC Topps カード ダルビッシュ有 選手 2枚セット|PayPayフリマ

ラーズ・ヌートバー 299枚限定 黒パラレル 【2023 TOPPS | JChere

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています