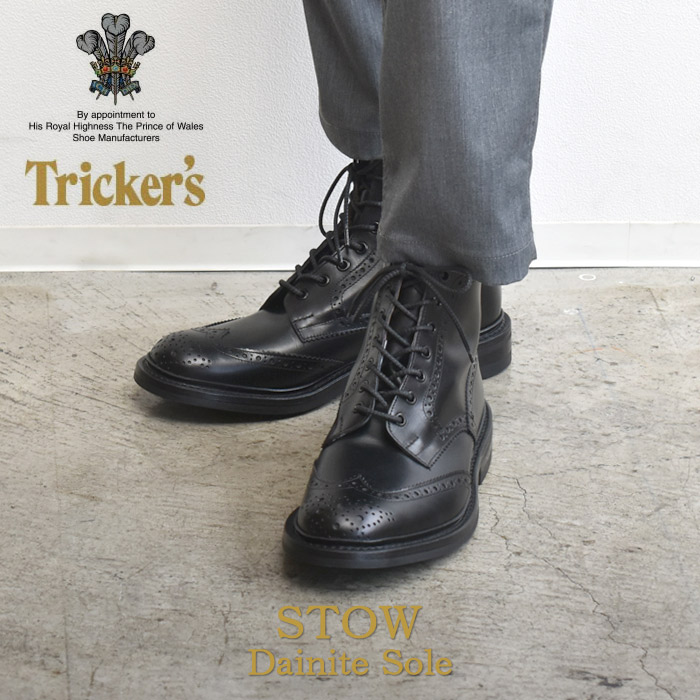

トリッカーズブーツ

(税込) 送料込み

商品の説明

履き口···紐

素材···本革

羽根···外羽根

カラー···ブラック

シューズ型···ウィングチップ

普通のトリッカーズブーツより細身になってます、見た目はオールデンのようです。商品の情報

| カテゴリー | メンズ > 靴 > ドレス/ビジネス |

|---|---|

| 商品のサイズ | 26.5cm |

| ブランド | トリッカーズ |

| 商品の色を | ブラック系 / ブルー系 |

| 商品の状態 | 目立った傷や汚れなし |

楽天市場】\月末月初SALE開催中☆/トリッカーズ ストウ TRICKER'S

Tricker's カントリーブーツ | labiela.com

Tricker's ブーツ | eclipseseal.com

熱販売 トリッカーズ Tricker's ブーツ グッドイヤーウェルト製法

カントリーブーツの代名詞

Tricker's ブーツ トリッカーズ | munchercruncher.com

トリッカーズ~ 王道のカントリーブーツ – Trading Post 良い革靴が

【トリッカーズ】カントリーブーツ購入のメリット5つ・デメリット3つ!【Tricker's ストウ】【エイジング】

カントリーブーツの代名詞

クリスマスファッション モンキーブーツ / Tricker's トリッカーズ

世界有名な トリッカーズ カントリーブーツ UK8-5 ブーツ

楽天市場】【SPECIAL SALE】トリッカーズ カントリーブーツ レディース

クリスマスファッション 【良品】Trickerker's トリッカーズ

安心発送】 トリッカーズ ブーツ カントリーブーツ ウィングチップ

正規販売店】 Tricker'sトリッカーズ カントリーブーツ レディース

交換無料! カントリーブーツ トリッカーズ TRICKER'S TRICKER'S

トリッカーズ Tricker's ブーツ-hybridautomotive.com

格安人気 美品 03-22112704 カントリーブーツ TRICKER'S トリッカーズ

大流行中! 牛革 カーフ モールトン Boots Brogue MALTON L5180 レース

トリッカーズのモンキーブーツ – Trading Post 良い革靴が見つかる

ブーツ不況の中 英「トリッカーズ」が青山店オープンで日本市場に

カップル メンズもレディースもトリッカーズカントリーブーツ|BLOG

Tricker's MALTON m2508 カントリーブーツ 7 トリッカーズ 公式の店舗

お得爆買い Trickers - Tricker's トリッカーズ モールトン 2508

トリッカーズの定番カントリーブーツ – Trading Post 良い革靴が

極美品” Tricker's(トリッカーズ)カントリーブーツ UK8.5 MALTON

正規取扱店】 カントリーブーツ トリッカーズ Tricker's △ size7 103

Tricker's(トリッカーズ)カントリーブーツが買取入荷致しました

履き続けるべき価値がある。トリッカーズの革靴&ブーツ名作リスト

楽天市場】【10/15限定☆最大100%ポイバック!】TRICKER'S

Tricker's(トリッカーズ)プレーントゥ ブーツ(Burford)ダイナイト

Tricker's トリッカーズ カントリーブーツ モールトン 9.5 ブラウン

大人女性の Trickers 【美品】トリッカーズ カントリーブーツ

履き続けるべき価値がある。トリッカーズの革靴&ブーツ名作

トリッカーズ カントリーブーツ サイズ26 海外ブランド 49.0%割引 dev

150 / 1127 試着程度 トリッカーズ カントリーブーツ 7-5 #M2508

トリッカーズ・カントリーブーツ ソール交換 | 靴修理RADIAN名古屋

楽天市場】【オータムフェス開催♪】 トリッカーズ TRICKER'S TRICKERS

送料無料 トリッカーズ メンズ ブローグ ブーツ ストウ TRICKER'S 5634

EXCELLENT USED】Tricker's トリッカーズ カントリーブーツ (Black/8

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています