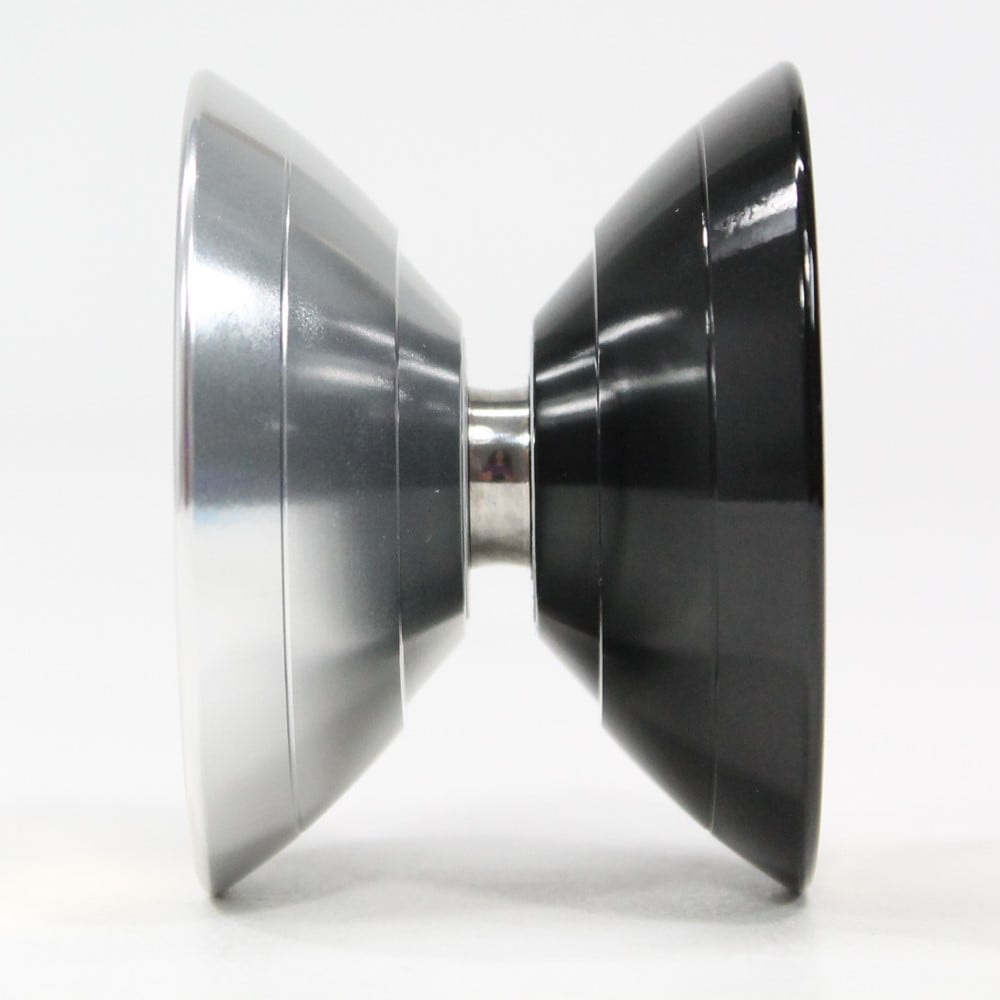

メタルチェイサー

(税込) 送料込み

商品の説明

製品特有の傷、ブレがあります。

ほとんど振っていないため製品仕様以上の傷やブレはないです。分解も数回です。

分解せず宅急便コンパクトで発送です。商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > その他 > ヨーヨー |

|---|---|

| 商品の状態 | 未使用に近い |

YoYoAddictにMETAL CHASERが入荷するも、わずか5分で完売 | yoyonews.jp

品番63】メタルチェイサー | 全てのUSED商品 | | ヨーヨーショップネスト

品番63】メタルチェイサー | 全てのUSED商品 | | ヨーヨーショップネスト

品番63】メタルチェイサー | 全てのUSED商品 | | ヨーヨーショップネスト

品番63】メタルチェイサー | 全てのUSED商品 | | ヨーヨーショップネスト

品番63】メタルチェイサー | 全てのUSED商品 | | ヨーヨーショップネスト

品番63】メタルチェイサー | 全てのUSED商品 | | ヨーヨーショップネスト

SPINGEAR - STURM PANZER SS-003 STAR CHASER

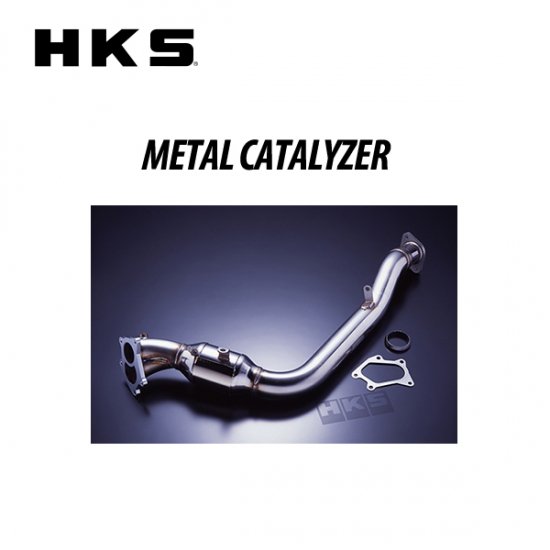

HKS メタルキャタライザー チェイサー (JZX100) メーカーNo:33005-AT002 /メタキャタ METAL CATALYZER - un-limited|エアロパーツ・車高調・マフラーから内装ドレスアップ用品まで カー用品専門通信販売店

ORCメタルシングルクラッチに変更】【450馬力】神戸六甲

Sturm Panzer Star Chaser Yo-Yo - Mono-Metal YoYo with Interchangeable Side Caps

ORC オグラクラッチ メタル ORC-559(ツイン) 標準圧着タイプ ダンパー

JZX100.110 1JZ-GTE vvt-i マーク2 チェイサー クレスタ リビルド

Chaser jzx100 black

マークⅡ/チェイサー シルバーグレー フロアマット|トヨタ パーツ通販!

D-MAX メタルガスケット エキゾーストマニホールド用 チェイサー

Chaser JZX100 with mountains background | Metal Print

Disney Store Cars Heavy Metal Lightning Mcqueen Chaser Diecast New

Chaser jzx100 | Metal Print

チェイサー JZX100 ORC メタルシングルクラッチ 取り付け

ORC クラッチ メタルシリーズ ORC-409(シングル) チェイサー JZX100

チェイサーのメタルポリッシュ・DIYに関するカスタム事例|車の

Amazon | 仮面ライダー チェイサー メタル キーホルダー | アニメ

Sturm Panzer Star Chaser Yo-Yo - Mono-Metal YoYo with

【スポーツカー➡パトカー➡ジェットメカに変形!】機甲警察メタルジャック ジャックチェイサー

チェイサーのメタルポリッシュ・DIYに関するカスタム事例|車の

JZX100.110 1JZ-GTE vvt-i マーク2 チェイサー クレスタ リビルド

まんだらけ | グランドカオス TOY - ☆本祭12/12(土)☆移転OPEN!!【TOY

チェイサー JZX100 メタル クラッチ トリプル ORC1000F ドラッグ専用

Toyota Chaser X30

Detech Chaser Metal Detector

DISNEY PIXAR CARS HEAVY METAL LIGHTNING MCQUEEN CHASER DISNEY

トヨタ チェイサー ツアラーV 純正5速 修復歴無 車高調 前置

Amazon | KTS 強化クラッチキット メタルディスク マークII/チェイサー

チェイサーのジェントルサウンド・ウエストゲーター・タービン

JZX100 チェイサーツアラーV _ORC メタルSEクラッチ ツイン (プッシュ式) 車引取&試走

タカラ ジャックチェイサー 機甲警察メタルジャック

Chaser JZX100

チェイサー JZX100 ORC メタルシングルクラッチ 取り付け

タカラ ジャックチェイサー 機甲警察メタルジャック

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています