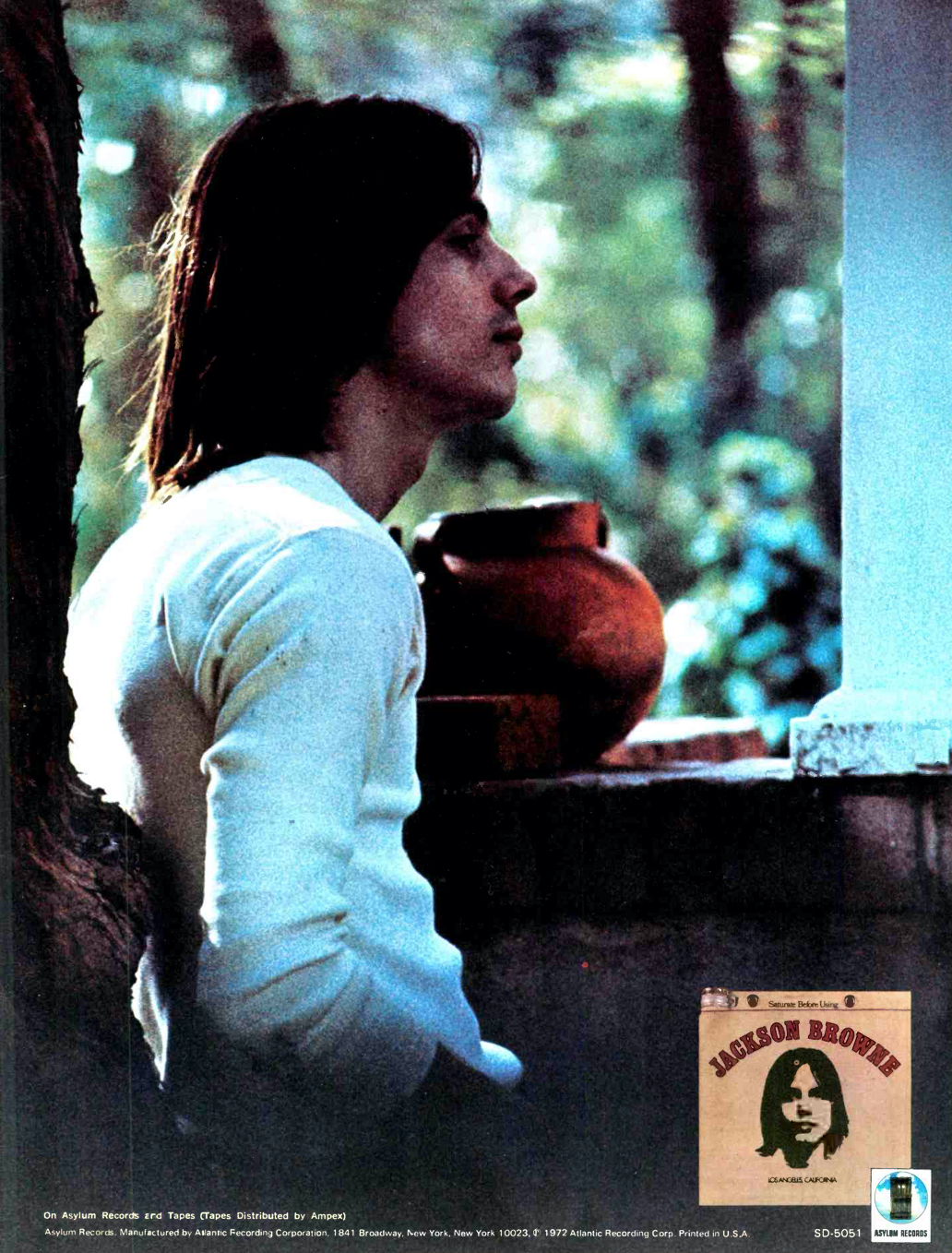

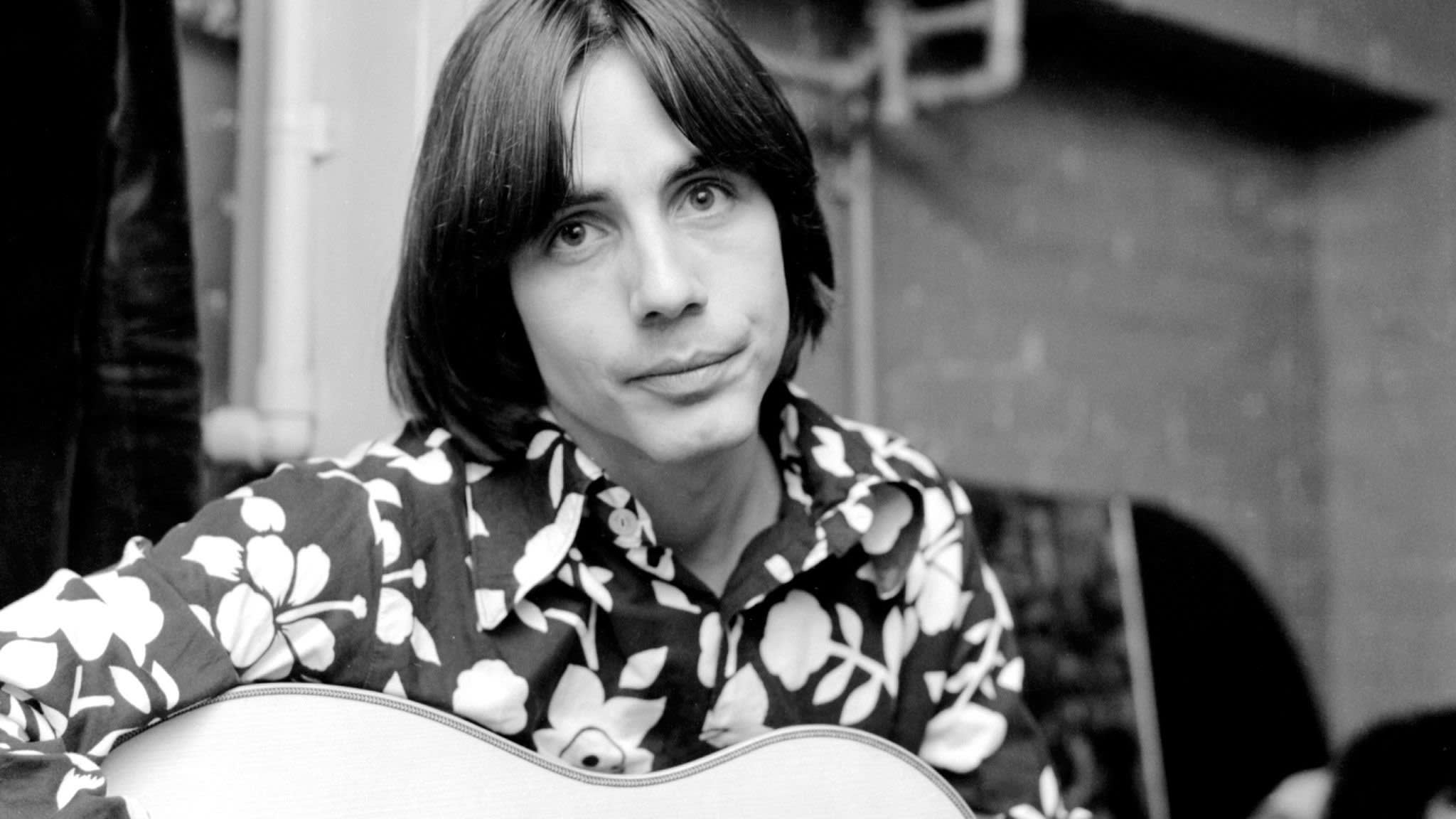

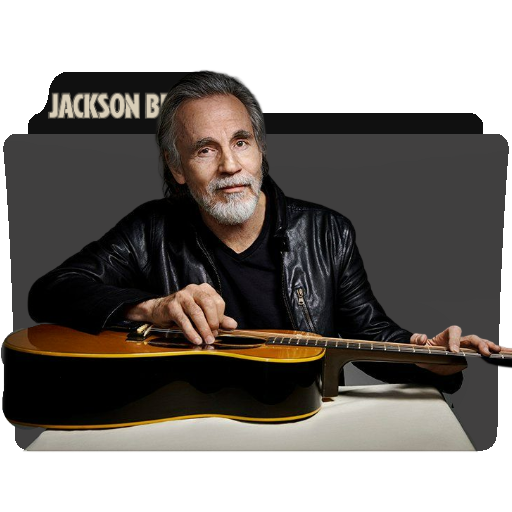

jackson browne / 1ST, 2ND (RARE!!MONO!!)

(税込) 送料込み

商品の説明

jackson browne / 1ST, 2ND (RARE!!MONO送料込み!! 発売中止になったBOXセットに収録予定だったモノラル音源2枚セットです。テスト制作の為、曲間のINDEXは設定されておりません。送料込み)

今回の再発ステレオ盤ではありません。2019年のモノラル盤です。商品の情報

| カテゴリー | 本・音楽・ゲーム > CD > 洋楽 |

|---|---|

| 商品の状態 | やや傷や汚れあり |

Jackson Browne (album) - Wikipedia

Jackson Browne (album) - Wikipedia

Jackson Browne (Saturate Before Using) - Album by Jackson Browne

Jackson Browne [Saturate Before Using] by Jackson Browne (Album

Jackson Browne - Jackson Browne - Amazon.com Music

50 Years Later: Revisiting Jackson Browne's Distinguished Self

Jackson Browne's 1st LP: An L.A. Troubadour's Debut | Best Classic

Jackson Browne | Biography, Songs, & Facts | Britannica

Jackson Browne – Jackson Browne (1972, PR - Presswell Pressing

Solo Acoustic, Vol. 1 - Wikipedia

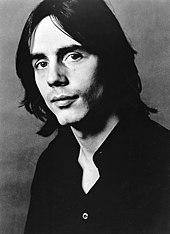

Jackson Browne - Wikipedia

Jackson and Ethan...his 1st son from his 1st marriage to Phyllis

Jackson Browne interview: Co-writer of the huge Eagles hit on new

Jackson Browne's 1st LP: An L.A. Troubadour's Debut | Best Classic

Jackson Browne - Jackson Browne (1972) Part 1 (Full Album)

These Days — a song of regret and remembrance written by the 16

The Super Seventies

Jackson Browne - Jackson Browne - Amazon.com Music

To Jackson Browne, Songwriting Is A Game Of Revision : World Cafe

Jackson Browne - Wikipedia

.png?itok=ELi2cXTS)

Saturate' the Market: On Jackson Browne's Debut | Classic Rockers

Music Friday: Jackson Browne Tells Story of Ruby Pendant 'In the

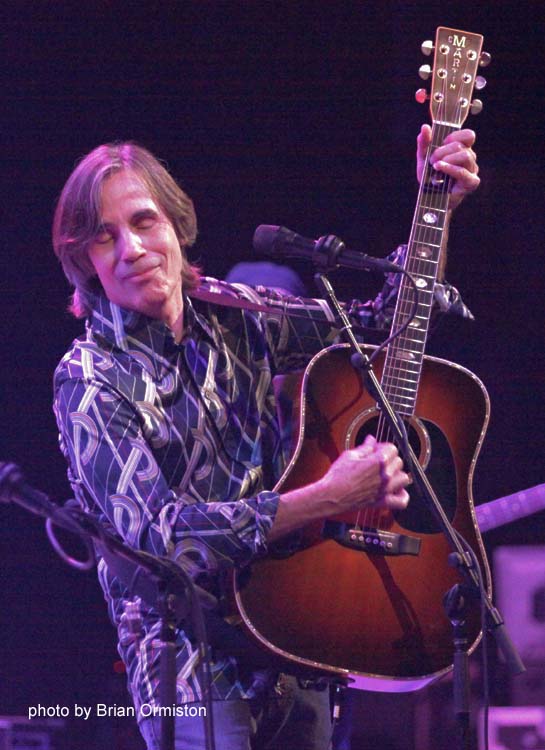

Madison, Wisconsin, USA. 1st June, 2012. Vocalist JACKSON BROWNE

James Taylor & Jackson Browne Tickets | 1st August | Pine Knob

Rolling Stone #161: Jackson Browne – The Uncool - The Official

With his second wife, Lynn | Jackson browne music, Jackson browne

popsike.com - JACKSON BROWNE* Late For The Sky MASTERING LAB USA

Jackson Browne - In Concert at Clark University 1974 - Past Daily

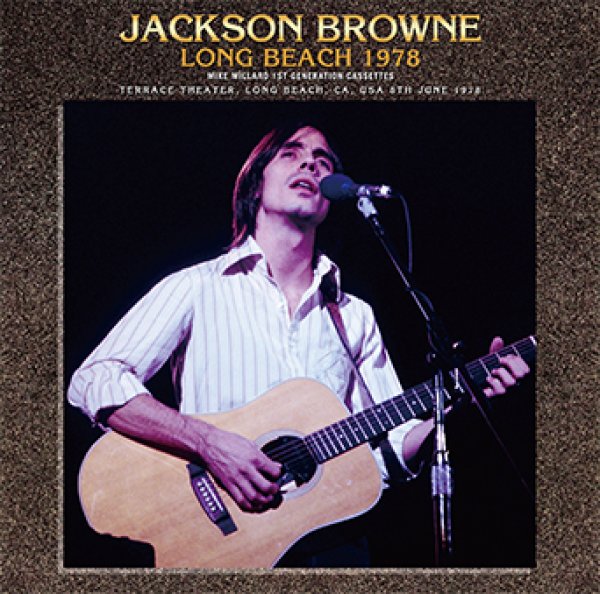

JACKSON BROWNE - LONG BEACH 1978 : MIKE MILLARD 1ST GENERATION

Jackson Browne plays to his crowd, his way, and everyone goes home

Jackson Browne, 50 Years On | Wickersham's Conscience

ミラード】JACKSON BROWNE - LONG BEACH 1978: MIKE MILLARD 1ST

Jackson Browne - Saturate Before Using | Page 3 | Steve Hoffman

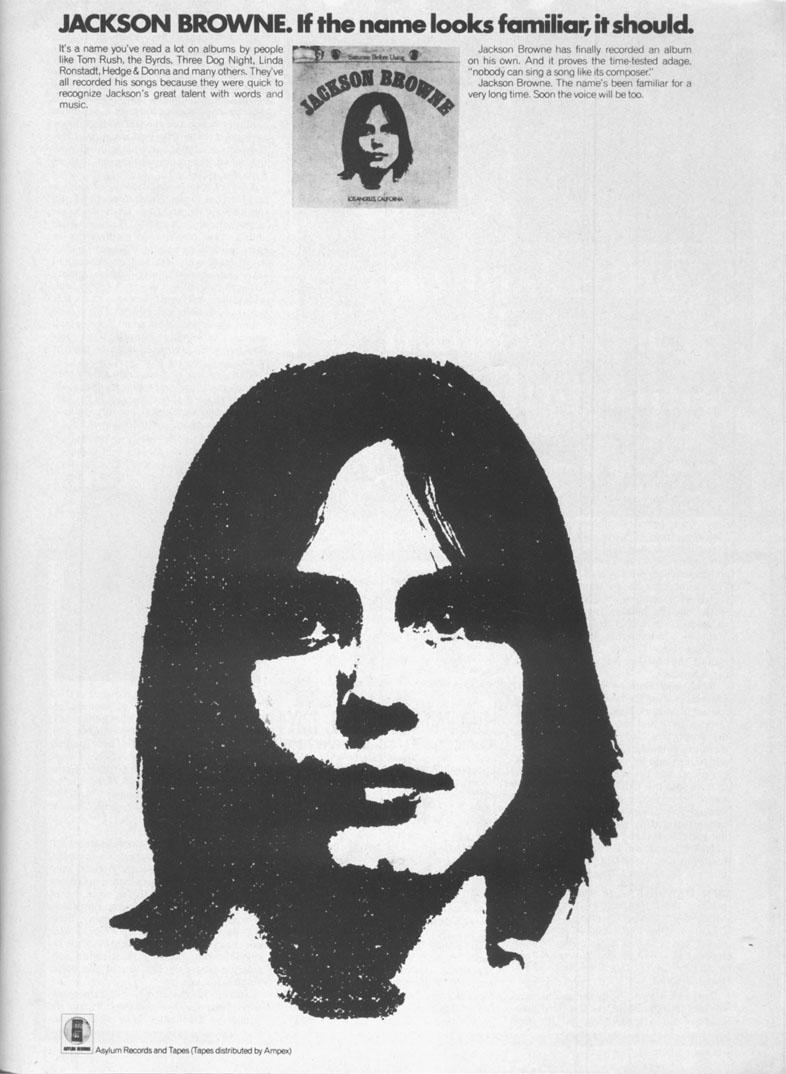

![JACKSON BROWNE, Jackson Browne [Saturate Before Using] USA 1st](https://i.ebayimg.com/images/g/iaMAAOSwXkZkJ0mZ/s-l1200.webp)

JACKSON BROWNE, Jackson Browne [Saturate Before Using] USA 1st

The 15 Best Jackson Browne Songs (Updated 2018)| Billboard – Billboard

Hemifrån

Jackson Browne: 'The best is always yet to come' - The Big Issue

Jackson Browne Running on Empty Vinyl Record - Etsy Canada

Jackson Browne (1) by KahlanAmnelle on DeviantArt

Jackson Browne live! : Illinois Entertainer

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています