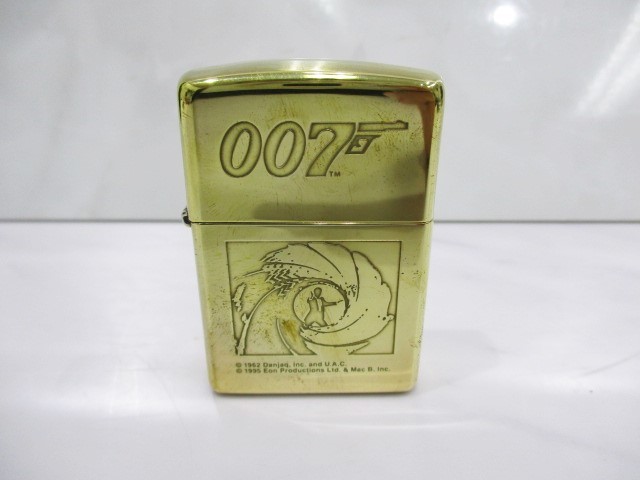

【専用】 zippo 007シリーズ 他7セット

(税込) 送料込み

商品の説明

コレクションBOXに仕舞ってありました。

画像の物が全てです。

未使用ですが、部品等、交換すれば使えると思います。

私にはzippoの事が全くわかりません。

長期家庭保管のためご理解頂きご購入下さい。商品の情報

| カテゴリー | メンズ > 小物 > タバコグッズ |

|---|---|

| ブランド | ジッポー |

| 商品の状態 | 新品、未使用 |

楽天市場】【ZIPPO】ジッポ/ジッポー ジェームスボンド・007

楽天市場】【あす楽】エス・テー・デュポン S.T.Dupont 葉巻カッター

楽天市場】【ZIPPO】ジッポ/ジッポー ジェームスボンド・007

楽天市場】【ZIPPO】ジッポ/ジッポー ジェームスボンド・007

現品限り一斉値下げ!】 ZIPPO L 古美 イタリックロゴ 1995 タバコ

現品限り一斉値下げ!】 ZIPPO L 古美 イタリックロゴ 1995 タバコ

現品限り一斉値下げ!】 ZIPPO L 古美 イタリックロゴ 1995 タバコ

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

楽天市場】ZIPPO ジッポー 29566 ダブルオーセブン 007 ブラックマット

楽天市場】ZIPPO ジッポー 29775 ダブルオーセブン 007 ダイアゴナル

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

【売り切り御免!】 S.T. Dupont デュポン ライター ライン1S

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

お気に入り】 zippo スターリングシルバー 2000年 ジッポライター

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

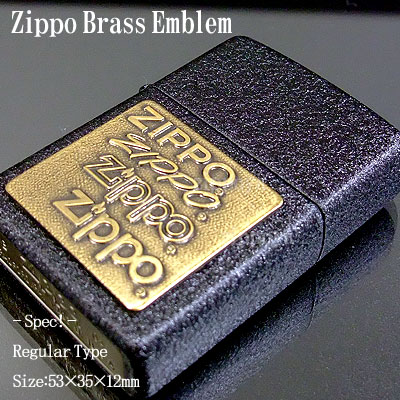

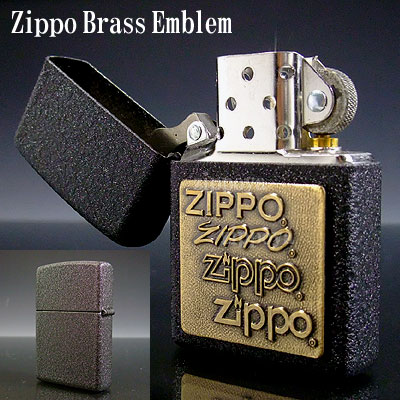

楽天市場】【ZIPPO】ジッポ/ジッポー Brass Emblem ロゴ ブラック

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

zippo(ジッポーライター)イニシャルZIPPO V刃彫刻 ニッケル鍍金 選べる10種類 オイルライター おしゃれ かっこいい ギフト 送料無料(ネコポス対応)

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

売り切り御免!】 S.T. Dupont☆デュポン☆ライター☆ライン1S

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

楽天市場】ZIPPO ライター 提灯 浅草 漢字 和柄 ジッポ グリーン

メーカー公式ショップ ジッポー エバンゲリオンの刻印です | cenou.bf

Zippo ジッポー James Bond 007 ジェームス・ボンド 29550|Zippo専門

楽天市場】70269 キン肉マン ZIPPOライター ロビンマスク・ライバル

楽天市場】【ZIPPO】ジッポ/ジッポー Brass Emblem ロゴ ブラック

Zippo ジッポー ウルトラQ No.4 タイトル

楽天市場】【ZIPPO】ジッポ/ジッポー Brass Emblem ロゴ ブラック

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

楽天市場】zippo ライター ジッポ ジッポー 純銀26番 Armor(アーマー

若者の大愛商品 elaine Mods JB DNA60 vape 18650 タバコグッズ

楽天市場】ハッピーラボラトリー 70010 ZIPPOライター 銀めっき無地

楽天市場】ハッピーラボラトリー 70002 ZIPPOライター 銀めっき無地

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

楽天市場】ハッピーラボラトリー 70010 ZIPPOライター 銀めっき無地

Amazon.co.jp: zippo セブンスター 限定品 ブラック 懸賞品 2016年製

楽天市場】ZIPPO ジッポ/ジッポー ライター Heart Design 49397

楽天市場】ZIPPO ジッポ ライター ジッポー Lighthouse in Grey 昔の

ヤフオク! -「007」(その他) (Zippo)の落札相場・落札価格

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています