スカルパ ドラゴLV EU41.5

(税込) 送料込み

商品の説明

スカルパ ドラゴLV EU41.5

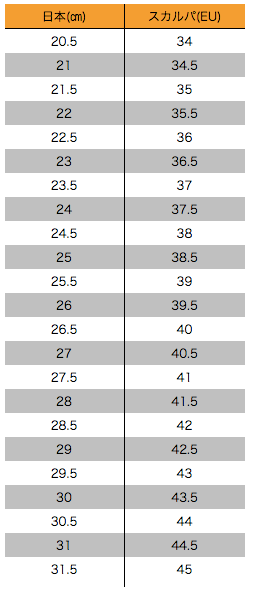

その他のサイズもありますのでご相談ください。

説明

多くのクライマーに支持されてきたドラゴのローボリュームモデル。トウボックスの高さを抑え、ヒールカップも細く硬めに造られています。従来のドラゴでは高いフィット感を得られない女性や子供や、細い足型の男性にお勧めできる1足です。

材質マイクロファイバー

ソールビブラム XSグリップ2 3.5mm

重量215g(#40、1/2ペア)

SCARPA Drago LVスカルパ ドラゴ LV

ブランド:ー商品の情報

| カテゴリー | スポーツ・レジャー > アウトドア > 登山用品 |

|---|---|

| 商品の状態 | 新品、未使用 |

クライミングシューズ スカルパ ドラゴLV EU41.5 ランキング2020 www

スカルパ ドラゴLV EU41 5 クライミングシューズ|PayPayフリマ

スカルパ ドラゴLV EU41 5|PayPayフリマ

SCARPA DRAGO LV スカルパ ドラゴLV

最新品即納】 ドラゴLV EU41.5 スカルパ 3GLVQ-m92760844672 rbi

SCARPA DRAGO LV スカルパ ドラゴLV

楽天市場】【 スカルパ ドラゴLV 】 SCARPA スカルパ クライミング

割引発見 スカルパ ドラゴLV EU41. スポーツ・レジャー | felcv.policia.bo

お1人様1点限り】 スカルパ ドラゴLV EU41.5 aob.adv.br

SCARPA DRAGO LV スカルパ ドラゴLV

【楽天市場】【 スカルパ ドラゴLV 】 SCARPA スカルパ

スカルパ SCARPA クライミングシューズ DRAGO LV ドラゴLV ボルダリングシューズ ロッククライミング 登山 シューズ レディース メンズ ★-Gulliver Online Shopping

SCARPA - クライミングシューズ スカルパドラゴLV EU41.5 28.0cmの通販

日本販売好調 クライミングシューズ スカルパドラゴEU41.0 アウトドア

SCARPA ドラゴLV EU41 ホワイト 美品 【ファッション通販】 51.0%OFF

日本販売好調 クライミングシューズ スカルパドラゴEU41.0 アウトドア

2023年最新】スカルパ ドラゴの人気アイテム - メルカリ

スカルパ ドラゴLV EU41.5 - 登山用品

【SCARPA】ドラゴLV – Mono Climbing Studio online store

SCARPA(スカルパ) DRAGO LV(ドラゴ ローボリューム) ※最小限のシャンク

スカルパ ドラゴ EU41.5 | www.ardenhealth.com

軽量な折り畳み自転車 クライミングシューズ スカルパ ドラゴLV EU41.5

2020年のクリスマスの特別な衣装 スカルパ ドラゴ EU41.5

ヨドバシ.com - スカルパ SCARPA ドラゴ LV SC20191 001 ホワイト EU38

スカルパ SCARPA クライミングシューズ DRAGO LV ドラゴLV

スカルパ ドラゴlv EU41.5 新着 8517円 newportlab.com

最新品即納】 ドラゴLV EU41.5 スカルパ 3GLVQ-m92760844672 rbi

スカルパ ドラゴLV EU41.0 スカルパ ◇世界限定 lps.cpot.com.br

スカルパ ドラゴLV EU41 0|PayPayフリマ

スカルパ ドラゴ EU41.0-

SCARPA】ドラゴLV – Mono Climbing Studio online store

スカルパ ドラゴLV EU41.0 スカルパ ◇世界限定 lps.cpot.com.br

スカルパ ドラゴ EU42.5 ボルダリング クライミング-

クライミングシューズ スカルパドラゴEU40.5 - 登山用品

スカルパ SCARPA クライミングシューズ DRAGO LV ドラゴLV

2020年のクリスマスの特別な衣装 スカルパ ドラゴ EU41.5

ヨドバシ.com - スカルパ SCARPA ドラゴ LV SC20191 001 ホワイト EU38

日本販売好調 クライミングシューズ スカルパドラゴEU41.0 アウトドア

SCARPA - スカルパ ドラゴlv eu38.5の通販 by shop|スカルパならラクマ

SCARPA DRAGO LV スカルパ ドラゴLV

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています