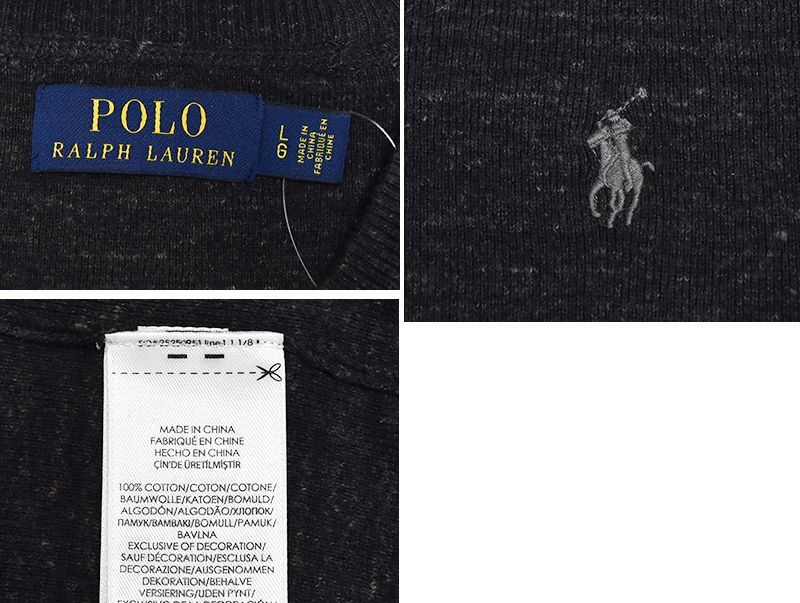

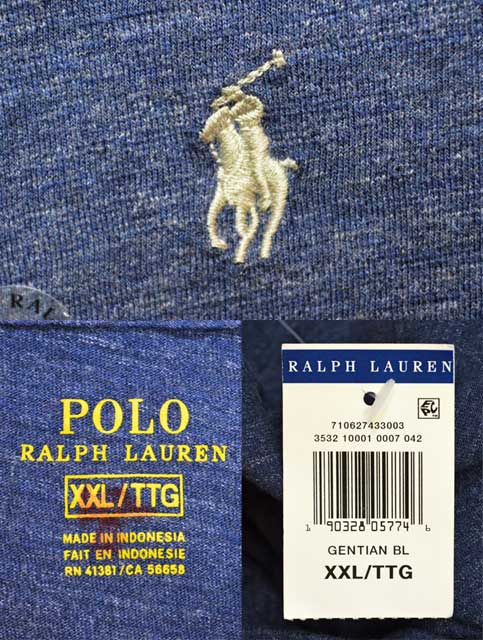

新品未使用 POLO RALPH LAUREN

(税込) 送料込み

商品の説明

ポロ ラルフローレンのポロシャツ3着セットです

新品未使用、タグ付き

カラー

白、紺、黒

サイズ

メンズS

袖丈···半袖商品の情報

| カテゴリー | メンズ > トップス > ポロシャツ |

|---|---|

| 商品のサイズ | S |

| ブランド | ポロラルフローレン |

| 商品の状態 | 新品、未使用 |

買得 【新品未使用】Polo LaurenポロラルフローレンポロシャツXL Ralph

Polo Ralph Lauren T-SHIRT AJUSTE EN COTON 海蓝色- Spartoo.cn免费送

大人女性の Lauren Ralph 新品未使用‼️POLO メンズ ベア スウェット

ホットセール 新品未使用 beams POLO RALPH LAUREN コラボ キャップ

セールお得】 POLO RALPH LAUREN - ポロラルフローレン Tシャツ 新品未

POLO SPORT RALPH LAUREN Black Watch Pattern Hoodie Jacket Men S From Japan New

☆激レア 新品 未使用 POLO RALPH LAUREN MA-1-

新品登場 ラルフローレン ポロ ポロベア Lauren Ralph Tote Bear Polo

M/新品未使用 POLO RALPH LAUREN 濃紺ロゴジャージ 当社の 8058円 www

超爆安 新品・未使用 ☆ POLO RALPH LAUREN ベア キャンバストート

Polo Ralph Lauren Blue 男士钱包| eBay

春のコレクション 新品未使用【POLO M チノパンツ LAUREN】メンズ

Polo Ralph Lauren メンズソックス 3足セット 新品未使用 人気No.1

Polo Ralph Lauren ミリタリーシャツ S 新品未使用品 【日本限定モデル

満点の ラルフローレン 新品未使用 Polo www.vekada.lt Ralph ポロ

新品未使用タグ付きPOLO RALPH LAUREN Tシャツ白S|代購幫

1円スタート売切り新品未使用ポロラルフローレンPOLO RALPH LAUREN

Polo Ralph Lauren / Polo Bear... - Closet second hand shop | Facebook

Polo熊小号牛仔布托特包

新品未使用品22 aw ポロラルフローレンインディゴネイティブ柄エルボー

メール便無料】 新品 未使用 polo ralph lauren WILDLIFE Cap キャップ

超爆安 新品・未使用 ☆ POLO RALPH LAUREN ベア キャンバストート

相場価格¥15,120- 新品未使用POLO by RALPH LAUREN ラルフローレン

新品未使用⭐RALPH LAUREN⭐復刻版貴重品⭐ 人気の雑貨がズラリ! 9690

新品未使用ポロラルフローレンPOLO Ralph Laurenオックスフォード

Polo Ralph Lauren POLO AJUSTE SLIM FIT EN COTON BASIC MESH 海蓝色

新品未使用 POLO RALPH LAUREN Tシャツ 90 170 2点 特価ブランド 62.0

高品質】 LAUREN RALPH 【新品未使用】POLO カスタム フィット M

新品未使用】POLO RALPH LAUREN 〈参考価格39,800円〉 【楽天

Polo Ralph Lauren Blue 男士钱包| eBay

新品未使用】 POLO RALPH LAUREN ポロ ラルフローレン 刺繍 帽子

日本製新作 POLO RALPH LAUREN KNIT DRESS SHIRTの通販 by Pistachio's

Polo Ralph Lauren L/S ロゴ刺繍 Tシャツ “新品未使用” - used&vintage

新品未使用【ラルフローレン】POLO RALPH LAUREN【チャコールグレー

ホットセール 新品未使用 beams POLO RALPH LAUREN コラボ キャップ

再入荷安い POLO RALPH LAUREN - 新品未使用 ラルフローレン ポロベア

ラルフローレン香水ラルフローレンポロディープブルーP・SP 75ml POLO

新品未使用 POLO RALPH LAUREN スリッポン 17cm|PayPayフリマ

Polo Ralph Lauren L/S ロゴ刺繍 Tシャツ “新品未使用” - used&vintage

代購代標第一品牌-樂淘letao-新品未使用タグ付き女性POLO RALPH

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています