最終価格!【新品未使用タグ付き】ドルチェ&ガッバーナ ワンピース10歳

(税込) 送料込み

商品の説明

★最終価格にお値下げしました!

【新品未使用タグ付き】

ドルチェ&ガッバーナ ワンピース10歳

着丈 約82cm

裏地付き

シンガポール正規店にて購入

一流メゾンらしい上質なシルクのワンピースです。

シックなお色味がとても上品な大人顔負けのワンピースです。

新品未使用タグ付きですが、自宅保管品ですので神経質な方は御遠慮ください。

ハンガーは付きません。

ドルチェ&ガッバーナお好きな方に。商品の情報

| カテゴリー | ベビー・キッズ > キッズ服(女の子用) 100cm~ > ワンピース |

|---|---|

| 商品のサイズ | 130cm |

| ブランド | ドルチェアンドガッバーナ |

| 商品の状態 | 新品、未使用 |

喜ばれる誕生日プレゼント 最終価格!【新品未使用タグ付き】ドルチェ

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

一部予約!】 じゃむおじさん様 専用 シャツ/ブラウス(半袖/袖なし

ドルチェ&ガッバーナ ワンピース 5 - ワンピース

豪華ラッピング無料 soorploom 1回のみ美品 ワンピース 4-5y

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

一部予約!】 じゃむおじさん様 専用 シャツ/ブラウス(半袖/袖なし

Dolce & Gabbana(ドルチェ&ガッバーナ) キッズワンピース

Dolce & Gabbana(ドルチェ&ガッバーナ) キッズワンピース

DOLCE\u0026GABBANA ドルチェ\u0026ガッバーナ デニム ワンピース

一部予約!】 じゃむおじさん様 専用 シャツ/ブラウス(半袖/袖なし

2023年最新】ヤフオク! - ワンピース(女性用 ドルチェ&ガッバーナ)の

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

ドルチェアンドガッバーナ♡Vネックノースリーブワンピース スリット

2023年最新】ヤフオク! - ワンピース(女性用 ドルチェ&ガッバーナ)の

Dolce & Gabbana(ドルチェ&ガッバーナ) キッズワンピース

有名人芸能人】 Vintage HERMES シャツワンピース 34 ひざ丈ワンピース

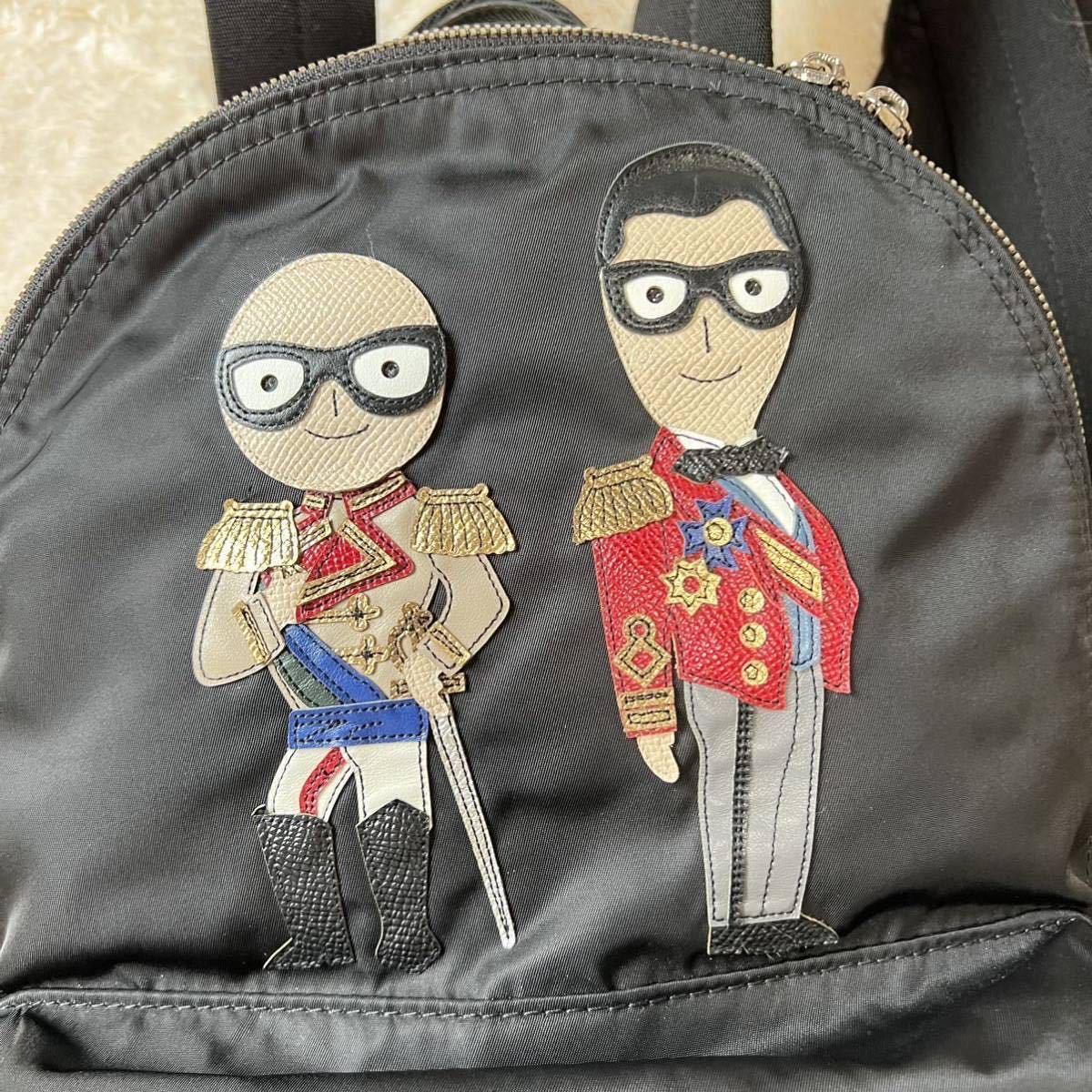

ドルチェ\u0026ガッバーナ リュック ブラック #gdfamily VALCANO

ドルチェ&ガッバーナ(DOLCE&GABBANA) ワンピースの通販 900点以上

![楽天市場】セール 30%off SALE [最大1000円offクーポン対象] ドルチェ](https://tshop.r10s.jp/mana2/cabinet/linecoupon1040.jpg)

楽天市場】セール 30%off SALE [最大1000円offクーポン対象] ドルチェ

2023年最新】ヤフオク! - ワンピース(女性用 ドルチェ&ガッバーナ)の

Dolce & Gabbana(ドルチェ&ガッバーナ) キッズワンピース

☆新品未使用タグ付き☆ドルチェアンドガッバーナ☆再値下げ☆完売商品

![楽天市場】セール 30%off SALE [最大1000円offクーポン対象] ドルチェ](https://tshop.r10s.jp/mana2/cabinet/20110613gazou/i610092.jpg)

楽天市場】セール 30%off SALE [最大1000円offクーポン対象] ドルチェ

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

D&G (ドルチェ&ガッバーナ) ワンピース パロディ 子供服 ss20 | 日本人

Dolce & Gabbana(ドルチェ&ガッバーナ) キッズワンピース

ドルチェ&ガッバーナ ザンビア 猫 ワンピース 新作(ワンピース)|売買

2023年最新】ヤフオク! - ワンピース(女性用 ドルチェ&ガッバーナ)の

2023年最新】ドルチェ&ガッバーナ キッズ ワンピースの人気アイテム

Dolce & Gabbana(ドルチェ&ガッバーナ) キッズワンピース

ドルチェ&ガッバーナ(DOLCE&GABBANA) 子供 ワンピース(女の子)の通販

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています